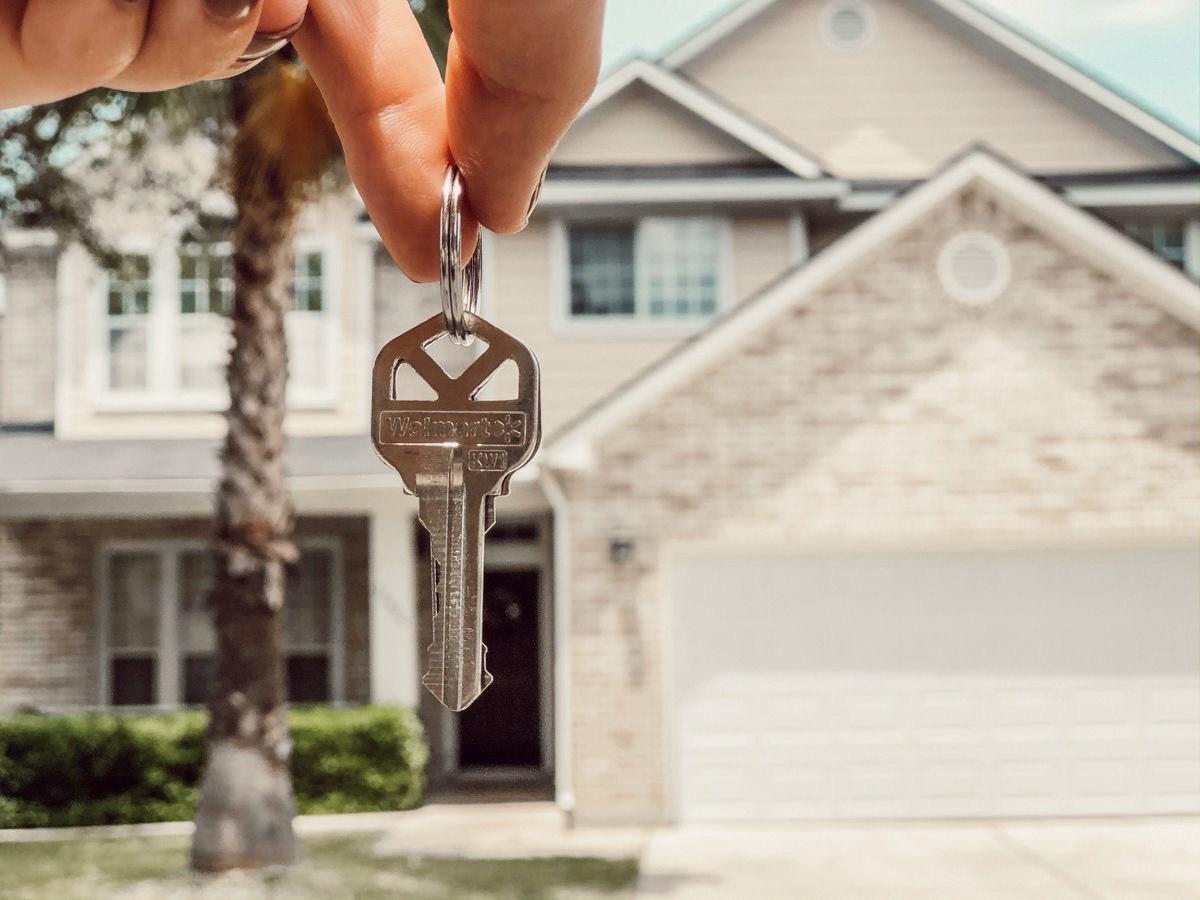

A Guide to Buying Your First Home in Today’s Market

Buying your first home is a significant milestone and a dream for many.

However, navigating the real estate market can be a daunting task, especially in today’s dynamic and ever-changing landscape.

In this comprehensive guide, we’ll walk you through the essential steps and considerations to help you make an informed decision when purchasing your first home in today’s market.

1. Assess Your Financial Readiness

The first step in buying your first home is to evaluate your financial readiness.

This involves understanding your current financial situation and planning for homeownership:

1) Budget: Create a detailed budget to understand how much you can afford. Consider factors like your income, monthly expenses, and any existing debt.

2) Down Payment: Determine how much you can afford for a down payment. In today’s market, a down payment of at least 20% is ideal to avoid private mortgage insurance (PMI).

2. Get Pre-Approved for a Mortgage

Once you have a clear understanding of your financial situation, it’s time to get pre-approved for a mortgage:

1) Shop Around: Research and compare mortgage lenders to find the best terms and rates. Consider fixed-rate and adjustable-rate mortgages to determine what suits your needs.

2) Gather Documentation: Lenders will require various documents, including pay stubs, tax returns, and bank statements. Be prepared to provide these.

3) Pre-Approval Process: The lender will assess your financial information and provide you with a pre-approval letter, indicating the loan amount you can qualify for. This letter strengthens your position when making an offer.

3. Determine Your Home Buying Criteria

Clearly define your preferences and criteria for your first home:

1) Location: Consider the neighbourhood, proximity to work, schools, and essential amenities.

2) Home Type: Decide between single-family homes, condos, or townhouses, based on your lifestyle and needs.

3) Features: List your must-have features, such as the number of bedrooms, bathrooms, and any specific amenities like a backyard or a garage.

4. Start House-Hunting

With your criteria in mind, begin your house-hunting journey:

1) Real Estate Agent: Hire a reputable real estate agent who is familiar with the local market. They can help you find properties that match your preferences and guide you through the buying process.

2) Online Search: Utilize online real estate platforms and apps to explore listings and narrow down your choices.

3) Attend Open Houses: Attend open houses to get a feel for different properties and neighbourhoods.

5. Make an Offer

When you find a property that meets your criteria, it’s time to make an offer:

1) Comparative Market Analysis (CMA): Your real estate agent will provide a CMA to help you determine a competitive offer price.

2) Negotiate: Be prepared to negotiate with the seller. Your agent can assist in this process, ensuring you get the best deal.

3) Contingencies: Include contingencies in your offer, such as a home inspection and financing contingency.

6. Home Inspection and Appraisal

Once your offer is accepted, it’s essential to conduct a thorough home inspection and appraisal:

1) Home Inspection: Hire a professional inspector to assess the property’s condition. This step helps identify any issues that may require repairs or adjustments to the sale price.

2) Appraisal: The lender will arrange for an appraisal to confirm that the property’s value matches the loan amount.

7. Secure Financing

After the appraisal and inspection are complete, finalize your financing:

1) Full Loan Approval: Your lender will review all necessary documents and issue the final loan approval.

2) Closing Costs: Be prepared for closing costs, which can include fees for appraisals, inspections, title insurance, and more.

8. Closing the Deal

The final step is closing the deal:

1) Review Closing Documents: Carefully review all closing documents and ensure you understand them before signing.

2) Closing Costs: Pay your closing costs and the down payment, typically through a certified check or wire transfer.

3) Receive Keys: Once the transaction is complete, you’ll receive the keys to your new home.

To summarise, buying your first home in today’s market can be challenging, but with careful planning and guidance, it’s an achievable goal.

By assessing your financial readiness, getting pre-approved for a mortgage, defining your criteria, and working with professionals, you can navigate the market with confidence.

Remember that the homebuying process may vary depending on your location and personal circumstances, so be flexible and open to adjustments along the way.

Ultimately, your first home is a significant investment in your future, and this guide should help you make informed decisions throughout the process.

Happy house hunting!